Take the right

lending decisions in

60 seconds

Digital lending made better

Digital lending made better

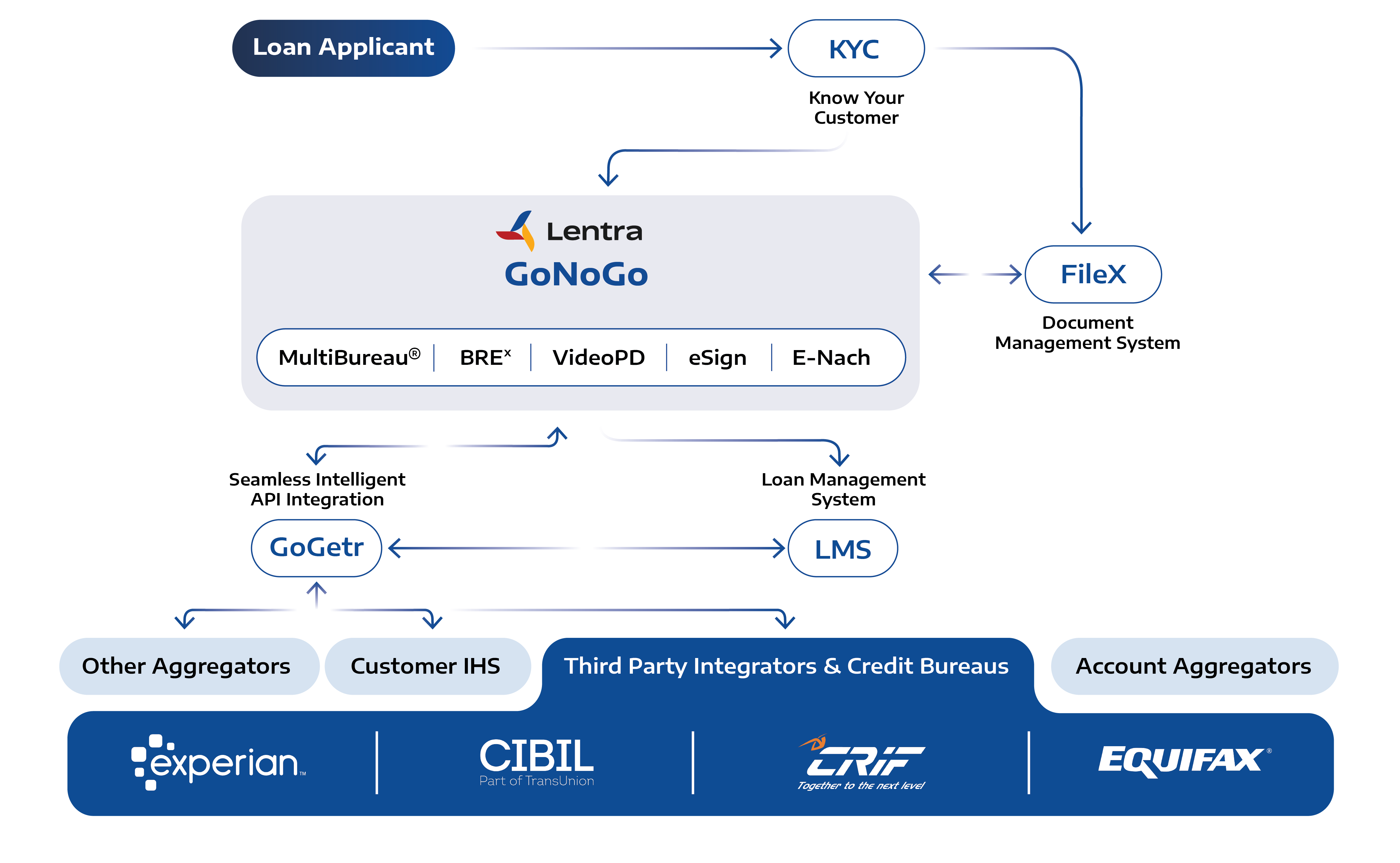

Get the power of next-gen AI and cutting-edge technology on your side to accelerate customer acquisition with GoNoGo, the digital customer origination platform and turn it into a strategic advantage. Designed to empower banks and other financial/lending organizations and make them future-ready, GoNoGo transforms digital lending processes with the power of Lentra’s technology and its comprehensive portfolio of products.

GoNoGo is an intelligent, intuitive and configurable scoring and decisioning platform that enables fast and efficient loan processing – in a minute or less – and a digitally driven seamless customer journey using AI/ML-powered business decision capabilities. An end-to-end solution that covers the entire lending value chain, GoNoGo is built to meet stringent regulatory demands while achieving quicker response times that give you an edge in the digital lending space.

Ready-to-deploy for rapid implementation and responsiveness

Complete loan origination capabilities to process applications on a single platform.

Fully digital loan processing with cashless loan disbursement

Faster turnround time at reduced per-application cost

Designed and developed with deep industry experience and expertise, the GoNoGo platform is designed to provide comprehensive loan origination capabilities and support to all lending products designed for Retail Customers (Salaried/self-employed), individual proprietors, MSMEs and Corporates. GoNoGo is integrated with major credit information infrastructures to source KYC, Financials, Tax/Invoice and Credit data real-time for all of the above customer segments.

GoNoGo is built on a flexible, configurable and rule-based workflow engine which allows the platform’s core Loan Origination System (LOS) capabilities to be easily extended to various secured and unsecured loans such as personal loan, auto loan, consumer durable loan, lap, education loan, overdrafts and invoice based loans, etc.

GoNoGo’s core capabilities built to support lending products make it ideal for Credit Card origination. With extensive ready-to-use integrations with leading CICs, regulatory bodies and third parties, GoNoGo provides straight through decision to issue virtual cards - a key enabler for instant card usage. The rich ecosystem and the third party integration also provide unique capabilities required for the corporate card origination such as Corporate Onboarding (Application Processing, KYC, Assessment of Financial Standings using various data sources, Authorised Signatories/Directors KYC, Credit Risk Assessment and Limit Assignment) and Employee Onboarding (Card Application Processing, KYC).

decrease in turnaround time

increase in approval rate

reduction in cost

straight-through processing

GoNoGo is built on a highly scalable micro services architecture, supported by a rich fabric of oft-used APIs that help in rapidly developing custom loan flows. The Lentra platform offers a complete loan origination solution with standard modules out of the box that include MultiBureau® , GoGetr (ready to use API lattice for 3rd-party data integrations), BREx (Stateless Business Rule Engine for Credit Decisioning), FileX (Document Management System), eKYC, KYC (Video KYC), VideoPD (Video personal discussions) and CYOR (Reporting and Data extract module to meet regulatory / MIS requirements)

The GoNoGo platform is today the preferred choice for banks and lenders looking to gain an edge in the market and forward-looking institutions looking to make the most out of digital lending opportunities today, tomorrow and beyond. See why, speak to us for a special demo.

Request Demo