Augment cash flow with digital independence and user-friendly automation. Lentra’s paperless self-service invoice financing system de-clutters the entire supply chain through intelligent APIs for transactions with limit settings, document uploads, checks and even term loans with minimum data entry points for merchants and dealers.

Approve merchants quickly and efficiently, ease communication for queries and reminders, and improve cross-selling with better engagement.

Move to digital hand-holding with a series of AI-driven services that makes invoice financing, transaction monitoring, loan management and merchant onboarding a seamless, efficient process.

Free resources, save time and reduce data-entry errors with an intuitive system that allows merchants to log-in and upload documents on their own, provides instant verifications and checks, and integrates with multiple channels for paperless disbursals and payments.

Lentra’s comprehensive service ensures that anchors and merchants profit from easy communication channels for queries and reminders, auto scaling and healing, transaction records and zero downtime deployments.

Swift onboarding, external data

validations, scheme detail showcase,

credit checks, multiple decisioning

roles and paperless disbursals

Pre-integrations via intelligent APIs for

stress-free onboarding of new

merchants

Single-window data input with

pre-filled smart forms and

post-approval digital documents

Advanced analytics for data on

category-based sales and volumes,

fraud and recovery

Highly customizable invoice financing

limits and sub-limits

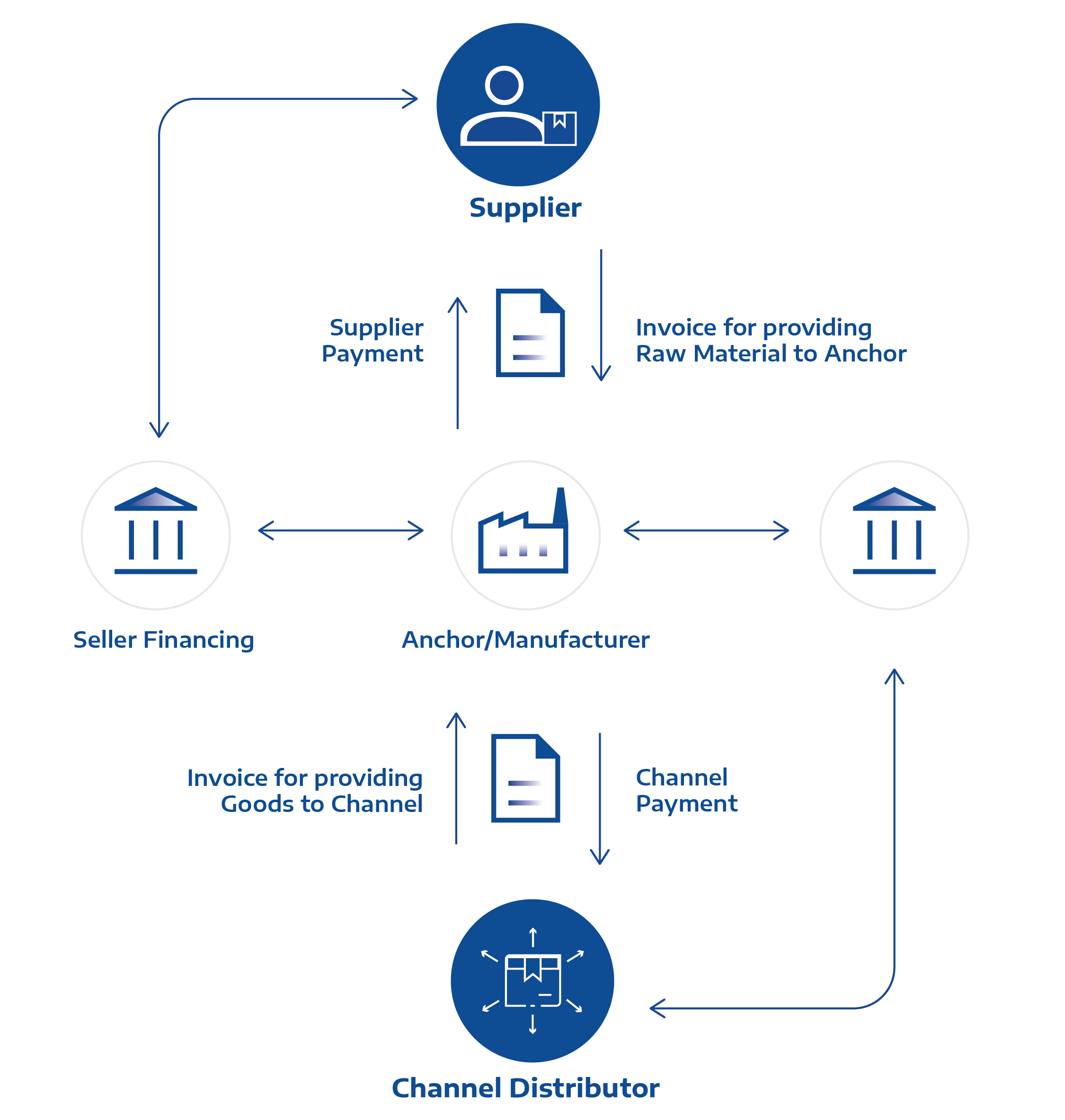

Facilitating both buyer-side and seller-side financing as required

Widen your anchor financing network with Lentra’s intuitive platform that supports faster onboarding, easy scalability and API-driven quick loan systems. Place yourself at a competitive advantage with data-backed rules configurable to your requirements.

Our pre-integrated APIs promote near-instant verification of applications and trigger risk analysis if needed, with provisions for sales manager overviews and interventions at appropriate levels.

Boost engagement with merchants via intuitive dashboards and ML-powered communication channels for launching schemes, festive promotions and reminders. Lentra uses the power of functional and performance automation to allow you to offer smooth transaction journeys to your clients while augmenting your lending opportunities.

Lentra’s microservices and events-based architecture widens your lending opportunities through fully automated, integrated invoice financing features that care for you, your anchors and their merchants. Step into the new world of digital lending with Lentra.

Request Demo