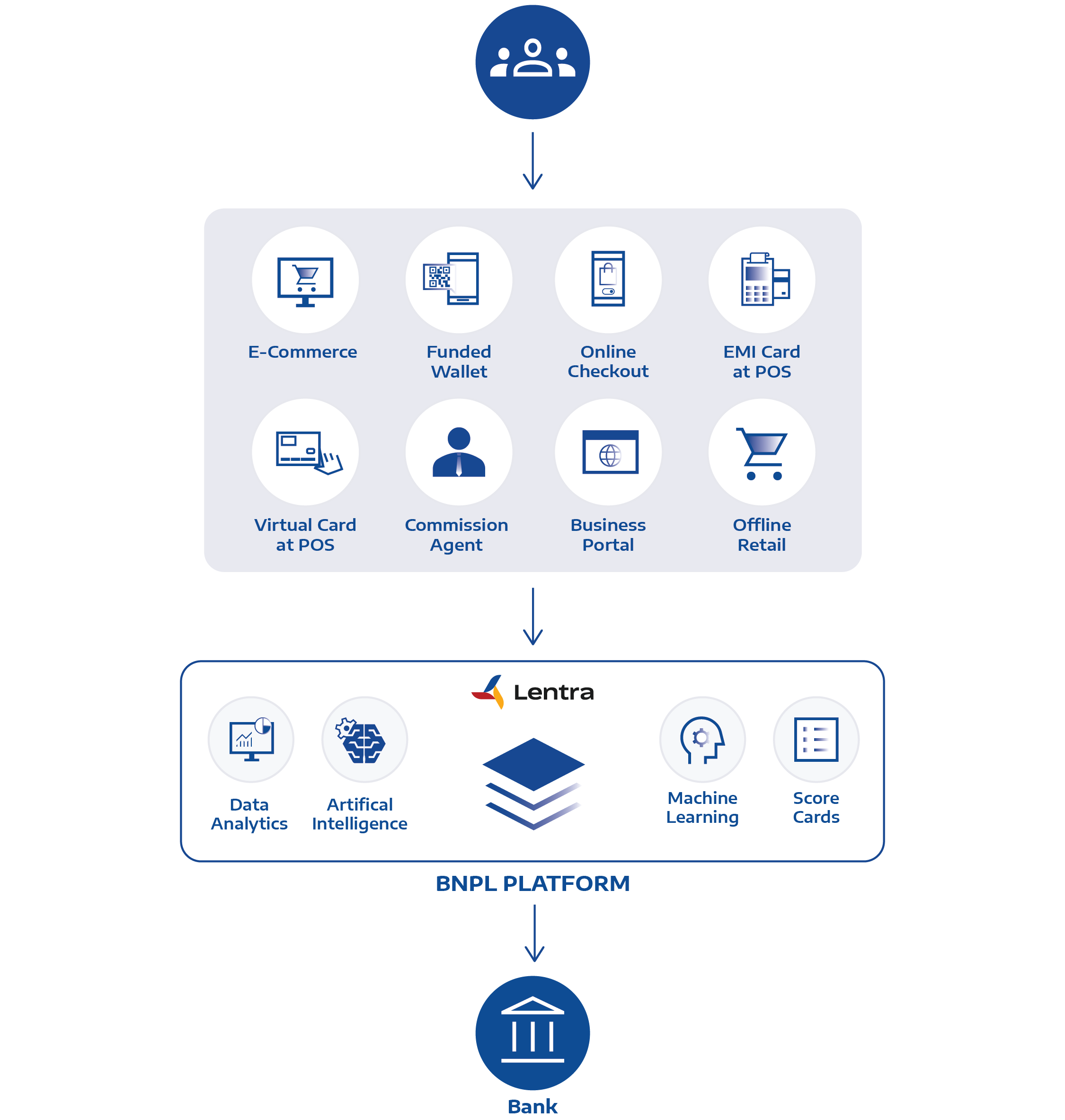

Prompt long-term relationships by eliminating barriers to quick yet secure credit and gaining deep insights into customer behaviour. With Lentra’s highly automated, self-serve BNPL solution, you leverage our fully integrated platform across an ecosystem that covers 250+ pre-integrated APIs over 70+ OEMs and 3rd party fintech service providers. Surge ahead of the competition on the back of highly customizable systems that span onboarding and customer origination to near-instant credit underwriting as well as disbursals and collections. A one-time integration of Lentra’s open APIs can seamlessly and quickly empower existing client platforms to drastically reduce go-to-market time.

Lead the move to the BNPL space by embedding

Lentra’s completely paperless, cloud-based solution onto your

pre-existing platform. Its fast integration and full-stack, secure

infrastructure encourage impressive cross-selling capabilities and

targeted lead generation.

Lentra removes the need for tedious documentation and filing,

offers quick and secure access to credit data for underwriting,

easily manages multiple loan accounts, and enables single-screen

tracking of debt collection. Our industry-grade security enables

banks and financial institutions to offer a highly transparent and

accessible customer origination and lending journey with just a

click.

BNPL is expected to become the country’s fastest

growing online payment method, and with Lentra’s quickly

scalable, easy-to-use, plug-and-play solution, your company will

be able to cash in on the ever-expanding customer base across

India.

Seamless integration with one of the fastest growing credit services

Full-stack, intelligent platform boasting decisioning in under 10 seconds

Configurable user journeys with vastly improved STP rates

250+ pre-integrated APIs enable a full range of lending services

Intuitive APIs provide quicker turnaround time from request to disbursal

Usage options via physical card, virtual card, NFC, UPI, QR codes and mobile wallets

Lentra provides you with the technology to confidently empower new markets to make purchases. Simply embed our unique, pre- integrated APIs into an existing system and sit back as service requests trigger them into motion, pulling vital information from internal storage and third-party agencies in seconds. It’s an end-to-end service that brings lead generation, onboarding, file management, underwriting, disbursal and collection together in a smart, user-friendly package. Our advanced business rule engine allows for customizable, fast and easy limit setting as well as order cancellation and transaction dispute management.

Bring convenient payments within easy reach of the end user while cross-selling on partner platforms with Lentra. Use our highly flexible BNPL solution to bump up new sales quickly even as you efficiently manage large volumes of merchant accounts and settlements.

Request Demo