Cash in on the growing need for small loans as the economy gets back on track. Bring in smart solutions from Lentra that offer data-driven underwriting, quick approval and user-friendly tracking.

Access and convert a largely overlooked borrowing market by opening up digital avenues for loans that suit their needs and dispensing with the disproportionately large volumes of paperwork. A typical STSL or STUL can be disbursed within minutes with straight through processing.

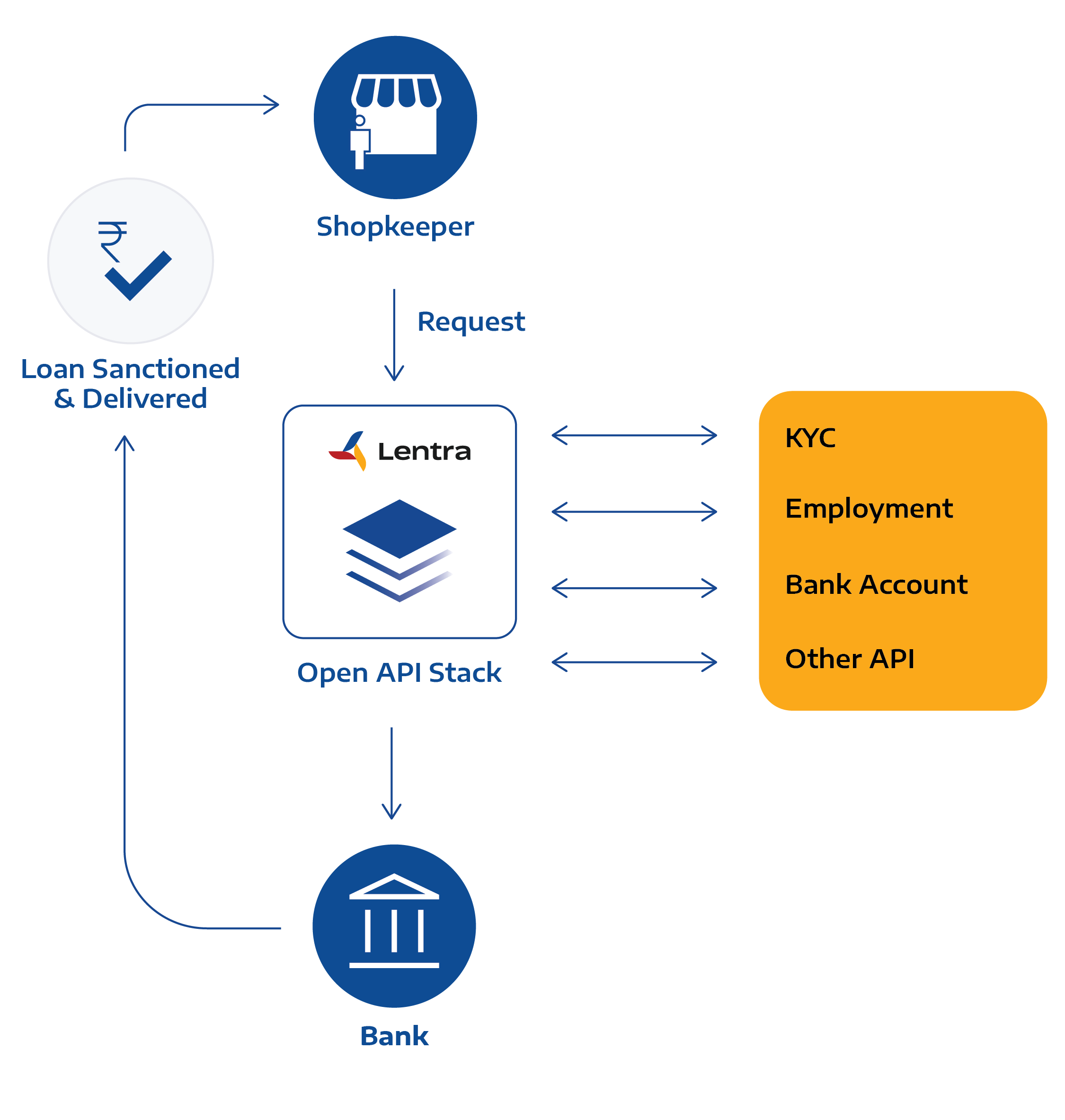

Lentra’s unique API-driven products make this process highly configurable, fast, simple and hassle-free.

Offer small ticket secured and unsecured loans to underserved borrowers as Lentra’s intelligent systems work rapidly and efficiently behind the scenes to mitigate risks.

We use a combination of various highly intuitive APIs to cover customer acquisition, detailed risk assessment, quality checks and disbursement so customers can go from request to funding in minutes.

Lentra’s highly configurable technology allows multiple variations in loan journeys. Our advanced ML-backed products facilitate connections between third parties to quickly and accurately provide credit scorecards, eliminate paperwork, and configure internal rules for better decisioning. The built-in analysis feature enables easy performance tracking while mobile-friendly user interfaces allow customers to easily check the status of their loan at any time. We smoothen out the loan process for everyone.

Remote access to documents, files and

data

Business rule engine ensures internal

rules are followed

Assess risk and credit scores in under a

minute

Identifies and highlights risks and

opportunities with third-party

agencies

Built-in analytics provide overview of

sales operations

250+ FinTech service integrations provide data for instant verification, validation and risk mitigation capability.

"The financial repercussions of the COVID-19 pandemic have driven many merchants and traders to opt for loans under Rs 100,000. Using Lentra, financial institutions can assist large volumes of clients remotely using a self-serve model that simultaneously bolsters risk assessment and compliance.

Our full-stack eco-system provides a 100% digital experience that gives both borrowers and lenders independence over their lending journey. In seconds, the currently inadequately serviced markets of small merchants and traders are able to access paperless funding no matter where they are located.

With quality, end-to-end lending powered by pre-integrated APIs, quick access to accurate credit scores, analytical feedback and more, lenders and financial institutions can offer a seamless small loans journey faster and better than ever before.

Optimize your processes with Lentra’s intelligent API-driven technology that puts you in sync with the new wave of retail lending. Save resources, time and money by opting for highly configurable solutions that shoot you into the financial future. Get on board now!

Request Demo