Take advantage of instant loans to boost business with Lentra’s state-of-the-art technology that connects you with the OCEN ecosystem. Our unique systems support loan request to disbursement in minutes, with underwriting completed within 20 seconds. Enjoy customizable integration with loan service providers, rich credit data, and instant and efficient

flow of funds through a hands-free, tested and certified process. Be the first to capitalize on India’s revolutionary open credit network.

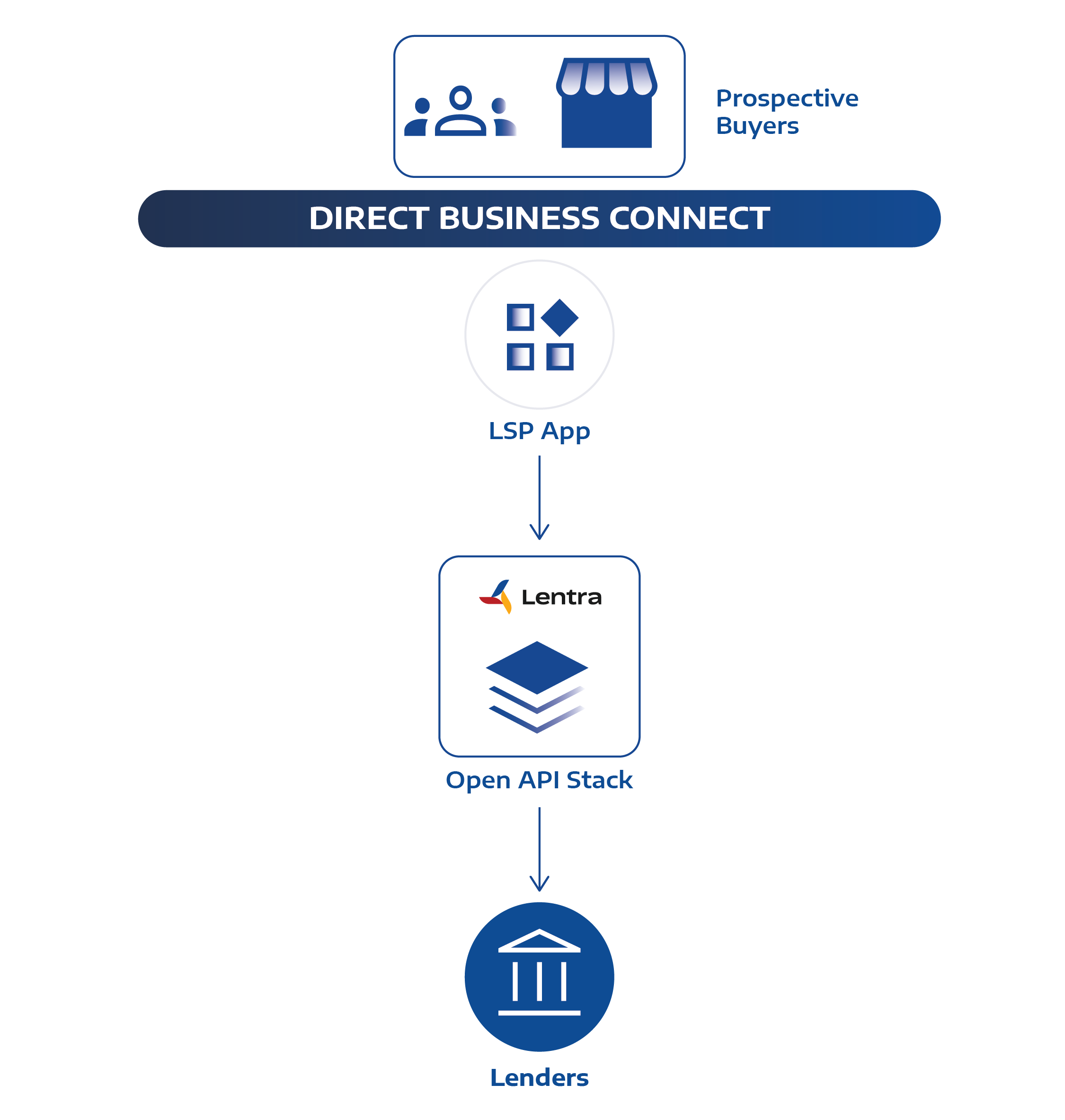

Lentra helps you plug into India’s digital loan disbursement eco-system with a fully automated solution to reach target audiences in seconds.

Unleash the intuitive power of our proprietary products to pull rich data on borrowers from multiple third-party locations and conduct risk assessment within half a minute. Our one-time integration of OCEN API launches you into the coveted circle of credit enablement for millions of micro, small and medium enterprises who currently have extremely limited access to formal credit.

With Lentra, you’ll be able to slash distribution costs, offer quick and digitized access to funds, access verified underwriting data, and enjoy seamless integration with loan service providers.

Easy to use, easy to scale up, easy to personalize

Bridge the credit gap with financial inclusion for all

Revolutionary lending network with open API framework

Assess credit risk with verified data from multiple sources in seconds

First mover advantages in becoming a part of the Indian OCEN ecosystem

Flexibility to choose the right fit lender, offering the best terms for your borrowing requirements

Lentra is a certified TSP for Sahamati and is also certified by CredAll. Leverage the mine of cash flow data from more than a hundred thousand retailers that our innovative technology underwrites for you almost instantly. Our customizable GoGetr and Multibureau® protocols pull in authenticated data from numerous sources in under a second, followed by a BREx intervention that underwrites it within 20 seconds. Lentra’s solution strengthens your position in the lending eco-system with seamless, customizable API integration for a quick and effective move to the OCEN network.

Consolidate your place in the digital future of lending by offering instant and efficient flow of credit to an expanding customer base. Our processes have been tested and certified by Penetolabs so you can sit back and watch cutting-edge automation do its thing.

A smart combination of innovative technology and open API frameworks can offer you access to more borrowers and credit data, shrink operations costs, and integrate easily with loan service providers. It’s about time you got on board.

Request Demo