Bridge the credit gap with AI-powered loan

origination and lending

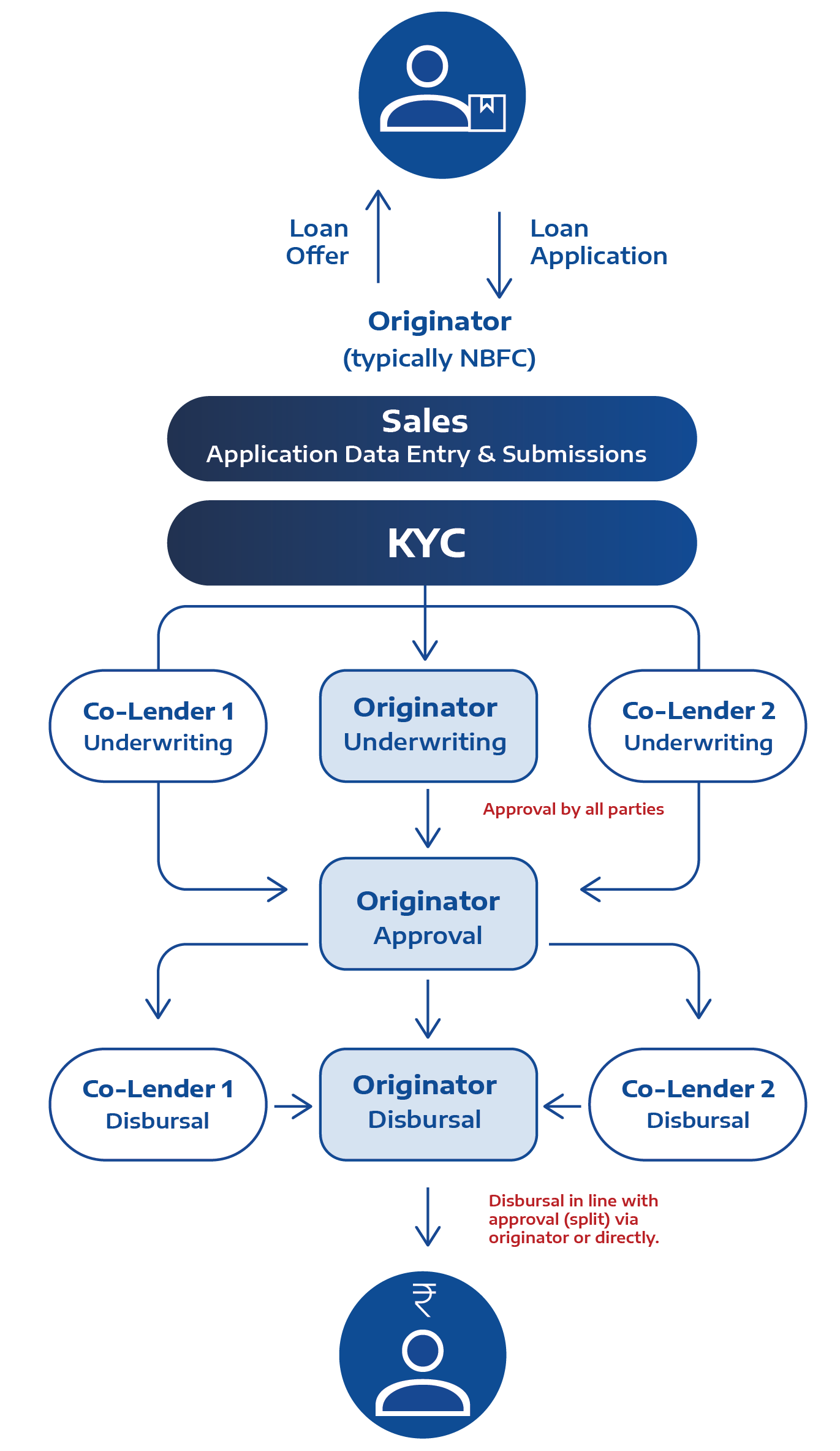

Promote large-scale end-user onboarding and lending across geographies with Lentra’s intuitive, automated co-lending systems. Our solutions bolster business opportunities among unexplored audiences by fully automating sales prospecting, assessment, onboarding, disbursement and repayment.

It’s a hassle-free, hands-free eco-system that limits the risk exposure of all lending partners using intelligent APIs for underwriting, data security, verification, disbursement and collection. This is the lending eco-system of the future.

Quick delivery.

Highly configurable.

Seamless operations.

Improve sales quickly and efficiently with API-driven architecture that unravels a new revolution in lending. Our solutions help reduce dependence on manual intervention and slash turnaround times when onboarding new clients and tracking collection bifurcations.

Lentra’s fully automated systems empower you with a one-time integration of ML-powered loan origination and/or loan management systems that you can use to evaluate large volumes of credit data from multiple sources, offer completely digital customer experiences, define credit product parameters, and ultimately meet the objectives of financial inclusion.

Customizable protocols collate and underwrite data in under 20 seconds as configurable APIs facilitate integration with multiple originating entities and lending partners. It’s a win-win system for all stakeholders.

Why do you need automated

co-lending?

Quick turnaround time

Reduces time to disburse loans from

days to minutes

Highly configurable

Tailored for any kind of journey,

product and offer

Plug-and-play integration

Originating entities and lending partners can easily integrate APIs for seamless, end-to-end operations

Risk and Compliance

Customized underwriting for partners;

rule-driven policy enforcement

Increased distribution

Scale up your co-lending business by upto 10x

Unified account statement

Offers borrowers a unified statement

of accounts for easier repayments

Lentra does it better

Lentra’s unique platform enables distribution networks to scale up as they grow. Governed by 100% customizable protocols, our loan origination and loan management systems make lead generation in new geographies and among new demographics simple and completely digital.

Our efficient and highly secure open-API technology boosts customer acquisition numbers at volumes you are comfortable handling at different points in your growth journey. Lentra’s powerful business rule engine and Go-No-Go platform assist with meeting strict regulatory demands, supporting all customer segments and reducing risk to your institution for any type of loan as your business booms.

Take on new markets confidently, backed by an intuitive eco-system of automated co-lending designs that can be deployed almost instantaneously.

Be a game changer in retail lending

Gain a competitive advantage on market outreach and client servicing by using Lentra’s intelligent eco-systems to improve end-to-end operational efficiencies. Our loan co-lending systems bring finance within easy reach of customers while boosting sales. All with the touch of a button.

Request Demo