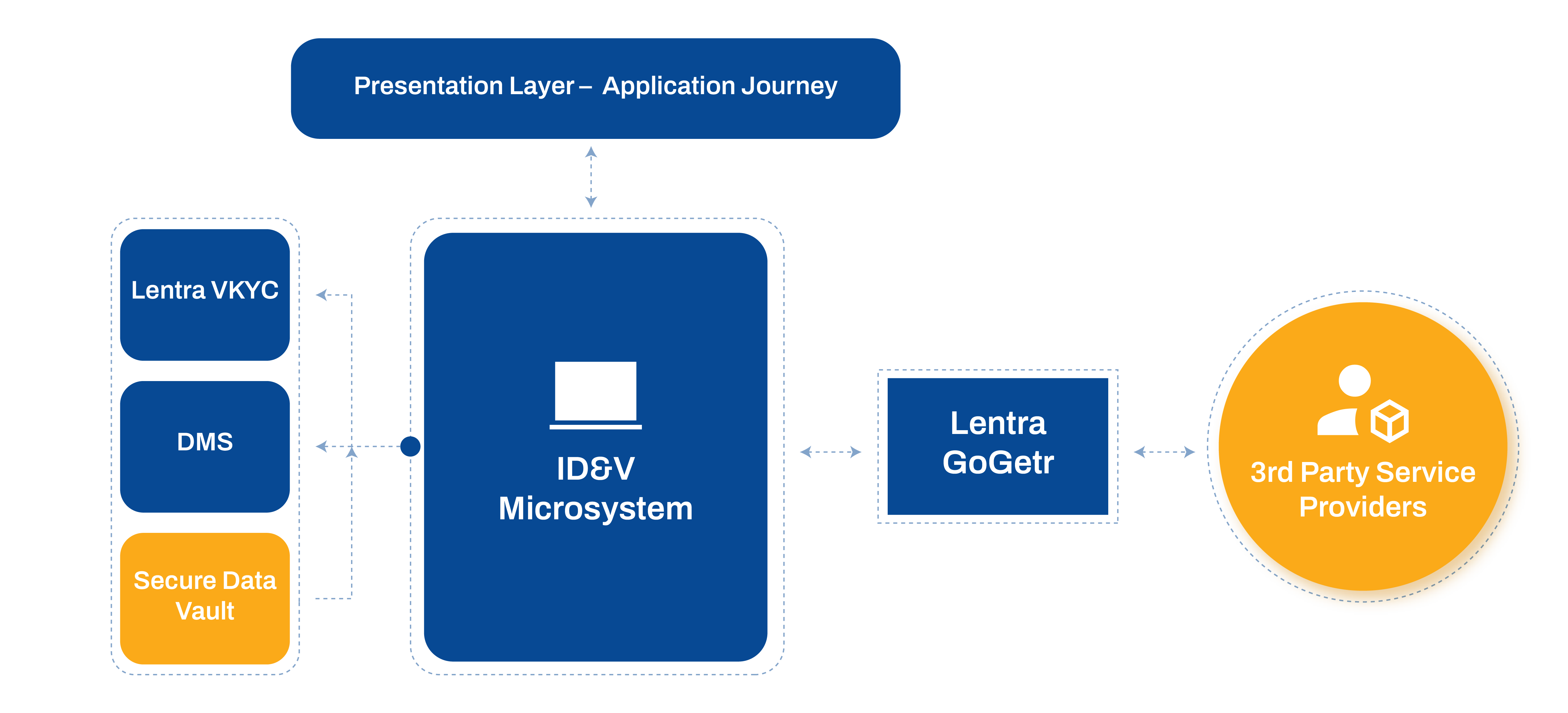

Safeguard your business against identity fraud and streamline operational processes with Lentra ID&V - a standalone Microsystem module with seamless integration capabilities. Provide secured storage and access mechanism for ID data to meet compliance requirements and to address privacy concerns.

Source and validate approved ID from different channels, electronically from the data source directly through APIs and through OCR from the ID documents. Get a secured storage and access mechanism for ID data to meet compliance requirements and to address privacy concerns.

ID search for Individual & Non-individual Customers including

cKYC (Individual: AADHAR, DL, PAN, Passport, Voter-ID,

MNREGA Card, Non Individual : Business PAN, GST, CIN, UDYAM).

AI/ML-backed liveness detection, face matching, and document verification guard against identity fraud and impersonation risks.

Connects directly to the government’s Digilocker service to

securely retrieve KYC documents (AADHAAR, PAN, DL).

Operates smoothly even at 144p, ensuring seamless performance in

low-connectivity areas.

Provides a flexible framework to integrate with any external

eKYC system, enabling fast and compliant identity verification.

Automatically recovers from connection drops without losing session progress.

Offers additional verification for utility documents such as

electricity or gas bills which are accepted as valid ID proofs

under deemed KYC.

Every session is recorded with tamper-proof watermarking and supports advanced post-processing hooks.

Includes easily pluggable UI widgets that can be embedded

into any loan or onboarding journey.

Enables multi-party video sessions for co-applicants, guarantors, and field agents—ideal for home, business, and secured loan use cases.

All KYC information is securely tokenized and stored in an encrypted data vault.

Supports a wide range of individual and business IDs

across multiple geographies, ensuring complete KYC compliance.

Reduces fraud and errors by validating IDs directly from

trusted sources and using OCR for accurate data extraction.

Ensures KYC compliance with regulatory standards

through secure, tokenized storage and privacy-first data handling.

Automates verification for faster onboarding, delivering a seamless and hassle-free user experience.

Accelerates approval processes, reduces turnaround times, and boosts overall service efficiency.

Enables straight-through processing with minimal manual checks, allowing for scalable, automated workflows.

Streamline the opening of savings, current, and salary accounts with real-time identity verification, digital KYC, and seamless form pre-filling.

Accelerate approvals with real-time KYC/KYB checks, fraud detection, and straight-through processing.

Simplify onboarding for mutual funds and insurance with automated ID validation and secure document retrieval.