Streamline Collateral Handling. Strengthen Lending Security.

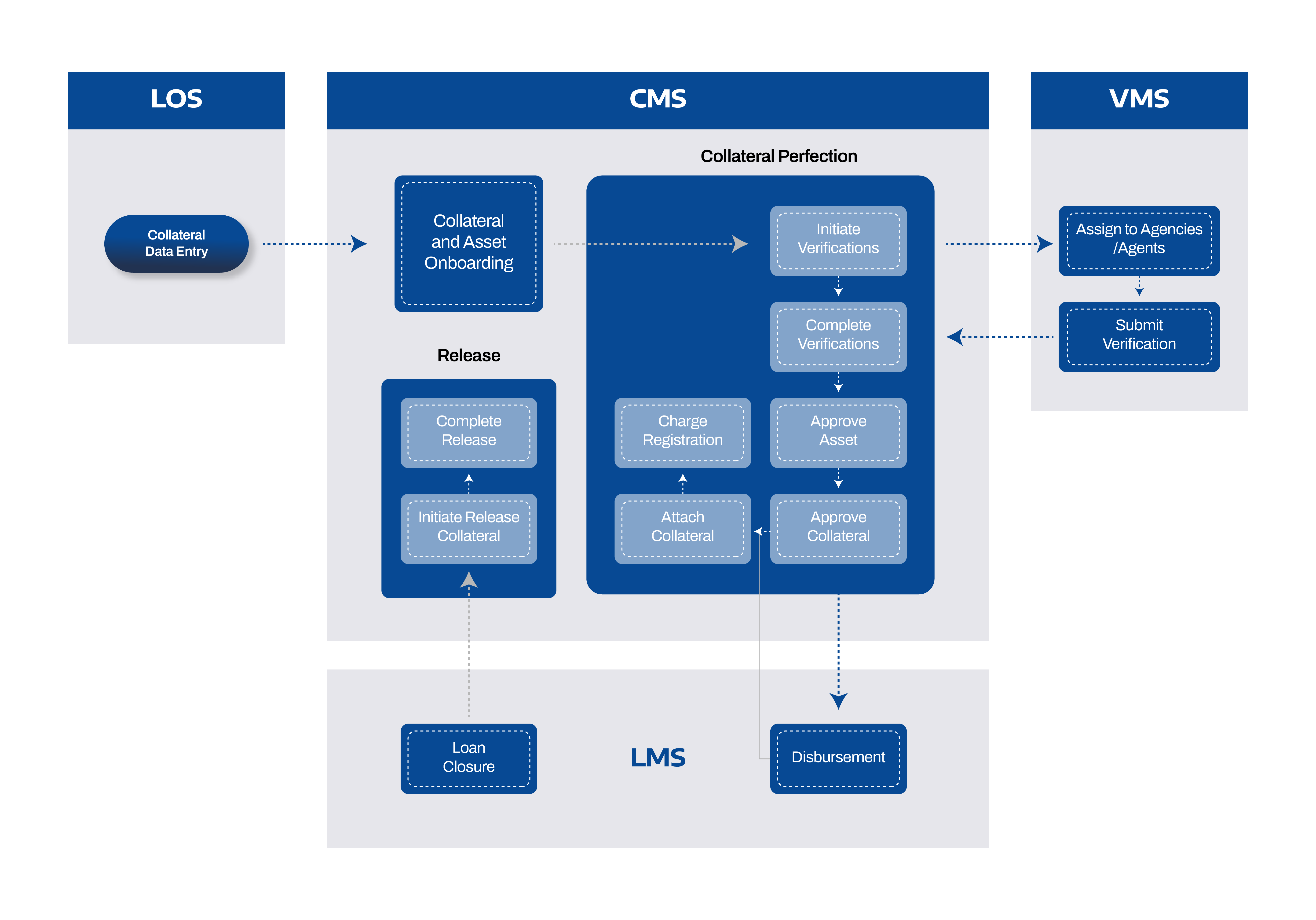

Handling collateral manually or through fragmented systems leads to delays, risks, and compliance issues. With diverse asset types and verification needs, lenders need an end-to-end system that unifies onboarding, valuation, legal, investigation, charge creation, monitoring, and release.

Lentra’s Collateral Management System, part of the Lending Cloud, offers a modular, API-first platform to manage collateral intelligently—from origination to recovery—across retail, commercial, and agri lending.

Add, update, or remove various assets—vehicles, gold,

property, livestock, FDs, insurance, and more.

Trigger and track valuations and legal verifications via Lentra

VMS or integrated partners.

Conduct field visits with flexible, configurable workflows.

Create, update, and approve liens, pledges, or hypothecations using a maker-checker process.

Link assets to multiple loans and track their status, compliance,

and updates.

Built to align with full loan workflows

Integrates easily with LOS, LMS, and external

systems

Dashboards for charge status, SLA tracking, and

compliance

Customize rules, roles, forms, and workflows

Gold, land, vehicles, property, livestock, and

more

Seamless ops with agencies and partners

Initiation and recording of asset based verifications e.g. valuation to correctly assess LTV leading to accurate and seamless credit underwriting and approval.

Registration with government bodies to record charges against the collateral, thereby preventing fraud and multiple financing.

Ability to maintain unified collateral record during loan servicing, perform re-verification and initiate recovery proceedings in case of default.