Lenders must verify a wide range of applicant and asset information identity, address, property, legal, and collateral. These checks must be quick, reliable, and auditable for scalable, secure lending.

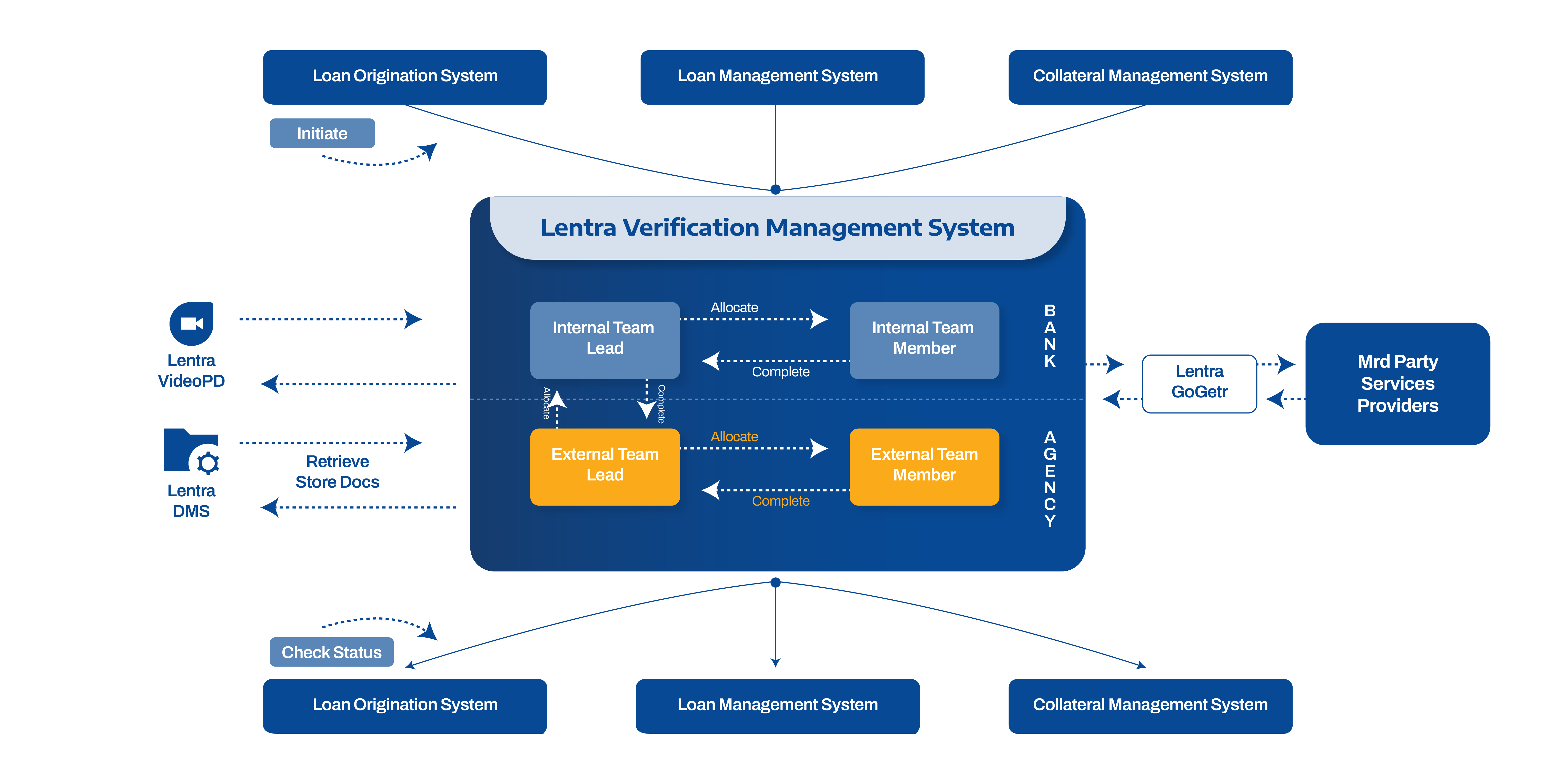

Lentra’s modular, cloud-native VMS integrates into the Lending Cloud to conduct field investigations, legal and valuation checks, and personal discussions through one intelligent platform.

Supports multi-address, multi-applicant checks with

geo-tagging and customizable forms.

Covers gold, movable, non-movable, agricultural, and

agri-allied assets.

Validates property-related documents to enable

charge creation.

Workflow for document verification through internal users

as well as agencies.

Enables applicant interviews via digital PD, capturing

qualitative insights.

Assigns tasks by applicant or address type, with dynamic reassignment support.

Enables secure, real-time onboarding via guided

video calls with live verification, multilingual support, and

low-bandwidth, multi-user access.

Structured data collection with rule-based risk evaluation.

Role-based access, audit trails, and seamless team/vendor collaboration.

Integrates with LOS, LMS, and third-party tools

Gold, land, vehicles, livestock, and more

Smooth collaboration with internal and external teams

Customize forms, scoring, roles, and workflows

Live dashboards and SLA tracking

Reduce turnaround time, cut costs, and minimize risk with structured data, geo-tagged verification, and built-in compliance workflows.

Verifying multiple customer addresses across regions helps accurately determine residential and/or business stability.

The FCU/RCU module enables thorough document verification via trusted agencies, reducing the likelihood of fraud.

Legal title searches help mitigate litigation risks and ensure compliance with regulatory standards.

Property and agricultural land ownership details are accurately assessed and stored for reference, aiding credit officers in sound decision-making.