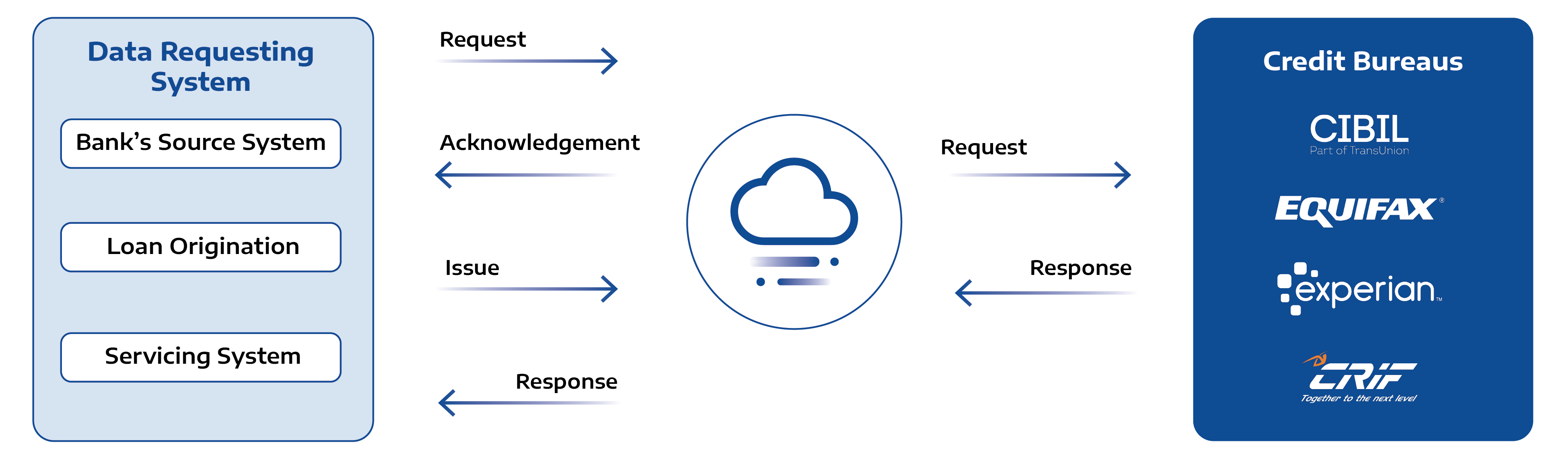

Simplify and streamline your credit enquiry process with MultiBureau®, Lentra’s state-of-the-art technology that gets you accurate credit scores from all major credit bureaus in just a matter of seconds. Simply feed your applicant’s information into the system using our easy-to-use interface and leave the rest to MultiBureau®. Regardless of data format, you'll effortlessly obtain the comprehensive credit report information you need, including credit check for loan, CIBIL report enquiry information, or credit score range, for informed lending decisions. With MultiBureau®, managing your credit checks, securing reliable credit scores has never been easier.

With features and capabilities developed keeping your credit processes in mind, and designed to work with only one data source – your Loan Origination System - MultiBureau® needs little to no training to use. What’s more, rule changes can be made instantly without any dependence on the IT team.

Our business credit services offer automated, easy-to-use enquiry process frees up employee time, plus reduces staffing needs.

Everything from generating credit scores to pulling stats is fully automated.

Get uniform results always, in sync with your macro policy, ensuring consistency across interactions with various credit agencies.

Eliminate the risk of human error in manual data entry and credit report check interpretation.

While MultiBureau® focuses on providing you with the most up-to-date credit information, it can't directly impact your borrowers' credit scores. However, by using the insights gained from credit report checks, you can guide your borrowers towards responsible financial practices that can help them understand how to improve credit score.

Enter your data in only one entry source - your loan origination system. MultiBureau® will configure it to automatically fill in the requirements of all credit bureaus.

MultiBureau® studies information to give you usable data analysis. For eg, if a credit score bureau generates scores for just 50% of your Mumbai clients, it will recognize the pattern and show you stats to analyse further.

Makes sure that the credit reports are in sync with your macro policy. Simply choose the bureau to which requests are to be sent as per your credit policy on your dashboard.

Be it Aadhar based e-KYC, Karza, Finfort, CreditVidya or any other, use all third-party applications directly with MultiBureau®.

MultiBureau® uses state-of-the-art applications based on Kafka, Spring, Tensorflow, Node.js, React and others, each of which serves a specific purpose to ensure speed while delivering the best of Artificial Intelligence and Machine Learning.

The deployment strategy, which uses Docker, builds and deploys applications at record speed while minimising errors.

Designed for high-functioning, cost-effective and faster deployment, you can also apply any technology to just a specific micro-service.

This feature helps MultiBureau® detect errors and ensures they do not occur consistently.

Ensures that the system runs smoothly and that errors are handled automatically.

This deployment strategy reduces downtime and risk by running two similar production systems, blue and green, with only one of them working at any point.

A feature embedded into the platform to improve efficiency

These features help the system upright by auto-testing functionality after any change is introduced.

MultiBureau® has changed the way some of the best banks and credit companies in the country go about their credit enquiry and has helped them reap the benefits of cost and efficiency.

Ready to make faster, more informed lending decisions and streamline your loan applications? Contact us today and learn how MultiBureau® can simplify your credit score checks!

Request Demo