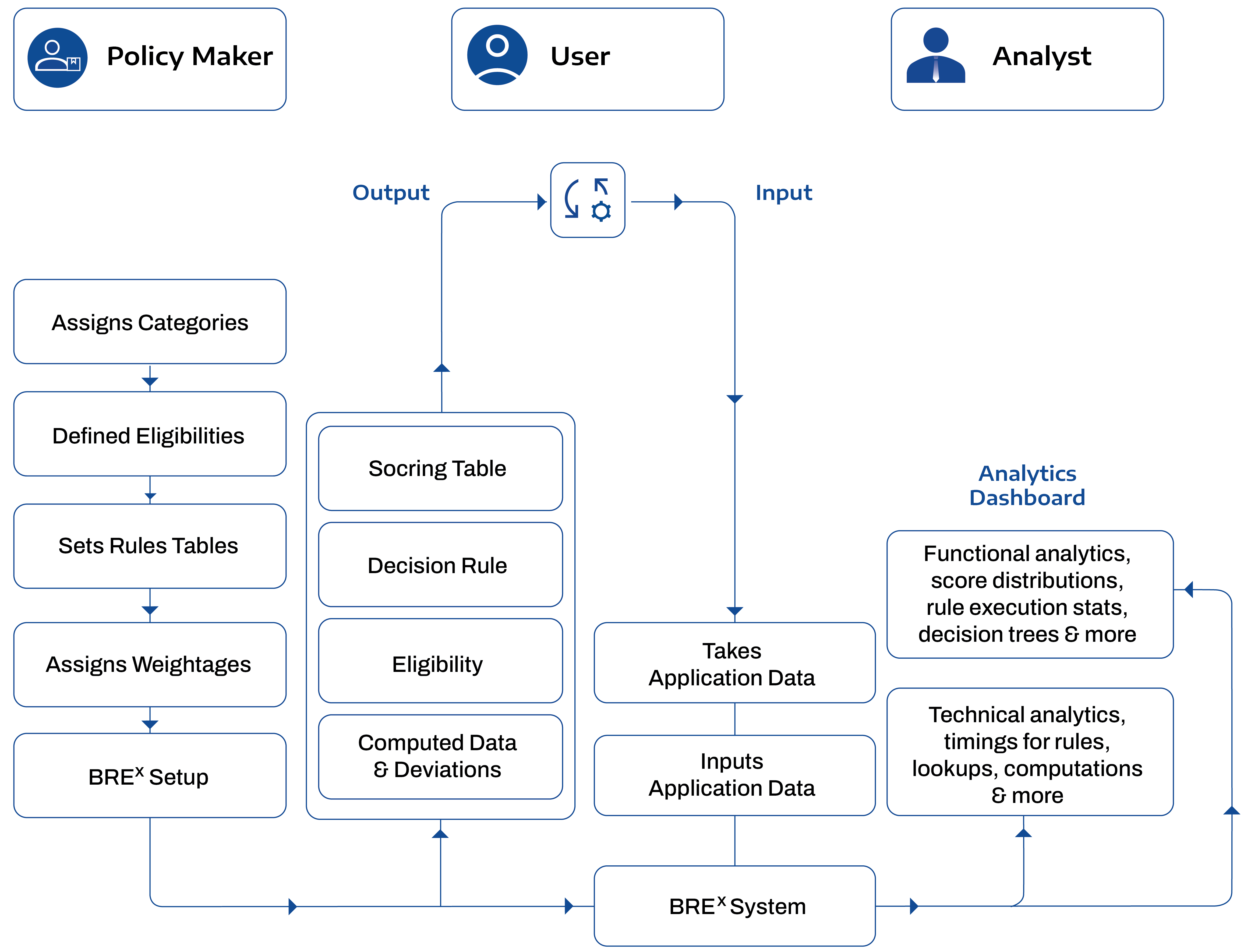

Ensure optimal decisioning and better business outcomes with BREx – a decision making tool that helps users evaluate applications. In a world where business is driven by data rules, BREx is an invaluable tool for credit policy designers and underwriters seeking to minimise NPAs. It is a differentiator for banks and delivers a competitive advantage.

The best, strategic decisions are taken guided by business rules, backed by data and the logical analysis of such data. BREx – Lentra’s Business Rule Engine – helps you set the rules without requiring any technology team support and evaluate applications against those rules.

BREx makes rule-setting easy, enables you to categorise and configure as per your needs while also providing built-in analytics that help determine application-wise performance both from a technical as well as functional perspective.

Quick and easy category, criteria and rules setup

Decision in less than 60 seconds

Easy-to-use GUI

Immediately integrate customised rule changes in the workflow

Complex credit decision rules support, multi-tier scorecards for custom risk scoring, automated (credit) policy deviations management and simulation for decision analytics

Built-in financial object models (bureaus, bank statements, Tax data, Financial Statements) for quick rules setup and built-in eligibility calculators

Intuitive web interface for easy business rules authoring and deployment, version control and granular access control for better security

The Rules Engine comes with a multi-tier scorecard definition module that can be used to generate custom risk scores as well as other decision scores

Untracked deviations from standard underwriting policies without meaningful mitigants, and a lack of proper review and approval, can be big contributors to a loan portfolio’s losses. BREx can scan through application data real-time (including data from other standard sources like the credit bureaus) to swiftly determine, log and raise policy & operational deviations to relevant personnel for review. This reduces turnaround times and errors significantly.

BREx allows complex loan eligibility computations using application data, derived risk scores as well as other derived (computed) fields.

Ability to host, trigger and communicate with the advanced ML / AI models in a seamless manner for consuming them real-time in the underwriting decision process.

Flexibility to configure and run multiple models / scorecards offline and compare their performance and/or results on a real time basis by leveraging our highly interactive user interface. Further to this, switch to the offline scorecards that emerge as potential challengers to existing live model/s in an effortless manner. The advantage is that you get to explore multiple scorecards leveraging different models / approaches / strategies, measure impact real-time and perform course correction (risk mitigation / business growth) all at the click of a button. Avoid delays in data extraction, cleansing, analysis and save eventual development time. ‘You sense it, you see it, you crack it’.

Plug the repayment information, Bureau scrubs data into the engine. Configure rules to validate the scorecard performance and take corrective actions.

Advantage - Shift from the age old mindset where LMS does not communicate back to Rule Engines/ LOS. In short, leverage the feedback loop in today’s machine learning world.

Rule optimizer being intelligent avoids users from creating redundant parameters and rules. Further to this, it provides detailed insights (reports) which helps optimize the rule engine from time to time, thus improving the overall efficiency.

STP

response time

increase in applications disbursed

increase in amount disbursed

Configurable integration with just about any application system

Low latency and highly scalable execution engine

Efficient horizontal scaling to handle variable traffic patterns

Consistent quick response times even at increasing transaction volumes

BREx has been deployed by some of the most talked-about banks & is behind the success of many credit policy designers & the secret of reduced NPAs for many banks. Yours could be next.

Request Demo